India’s ESG Disclosure Shift: What BRSR Core Really Demands in 2026

Indian ESG reporting has reached an inflection point. The 2025–26 reporting cycle marks a clear transition from intent-based sustainability disclosures to evidence-driven, regulator-ready ESG accountability. With the introduction of BRSR Core, ESG reporting in India is no longer about demonstrating awareness. It is about proving credibility.

For many organizations, this shift feels subtle on the surface but structural at its core. BRSR Core is not an incremental add on to the Business Responsibility and Sustainability Report. It is a test of whether ESG disclosures can withstand the same scrutiny as financial reporting.

The inflection point in Indian ESG reporting

Until recently, ESG reporting in India allowed significant narrative flexibility. Companies could describe initiatives, aspirations and policies with limited pressure to demonstrate consistency, comparability or assurance readiness.

BRSR Core changes that equation. It signals the regulator’s intent to move ESG reporting closer to financial discipline. Quantified metrics, standardised indicators, traceable data and third-party assurance are no longer future expectations. They are current requirements for the largest listed companies.

This is why 2025–26 represents a structural shift. ESG reports are being read differently by regulators, investors, lenders and boards. The question is no longer whether a company is committed to sustainability, but whether its disclosures are credible, comparable and defensible.

What is materially different now

The most visible change is the emphasis on mandatory key performance indicators over narrative explanations. While storytelling still matters, it must now be anchored in measurable outcomes.

Value chain disclosures are another significant shift. Companies are expected to move beyond their own operations and account for supplier practices, Scope 3 emissions and social metrics across the value chain. This requires data that many organizations have never formally collected or governed.

Third-party assurance further raises the bar. ESG data must now stand up to independent verification. Assumptions, estimation methods and boundaries are being examined with increasing rigour. What once passed as reasonable disclosure is now being tested for consistency and robustness.

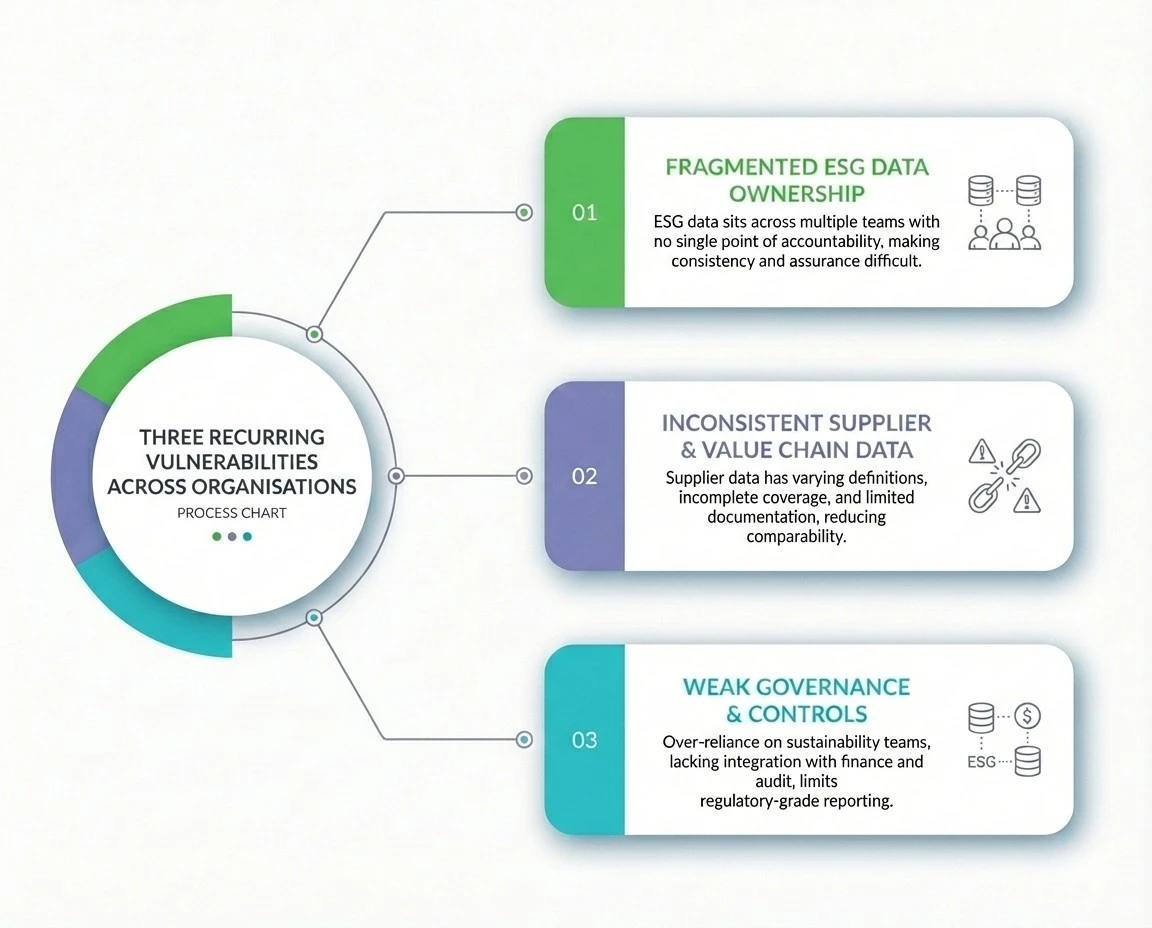

In working with organizations across sectors, three recurring vulnerabilities emerge.

First, ESG data ownership is fragmented. Environmental, social and governance data often sit across multiple teams with no single point of accountability. This makes consistency and assurance difficult.

Second, value chain methodologies are inconsistent. Supplier data is collected using varying definitions, incomplete coverage and limited documentation. As a result, disclosures are difficult to compare year-on-year or validate externally.

Third, ESG reporting is still overly dependent on sustainability teams. Without integration with finance, risk and internal audit functions, ESG data lacks the controls and governance needed for regulatory grade reporting.

What credible reporters are doing differently

Organizations that are navigating BRSR Core with confidence are making deliberate structural choices.

They are converging ESG and finance functions, applying financial reporting discipline to non-financial data. They are preparing for assurance early, not as a last-mile exercise. This allows time to strengthen data systems, documentation and internal reviews.

Most importantly, boards are becoming more involved. Credible reporters use board-level ESG dashboards that translate sustainability performance into decision relevant insights. This elevates ESG from reporting compliance to strategic oversight.

The Bevolve perspective

At Bevolve, we see BRSR Core not as a compliance burden but as a strategic opportunity. Organizations that respond thoughtfully can use this moment to strengthen governance, improve data credibility and build trust with stakeholders.

The strongest ESG reports in 2026 will not be the longest or most polished. They will be the most defensible. They will connect data, narrative and strategy in a way that reflects both ambition and operational reality.

Building such reports requires more than templates. It requires clarity of ownership, disciplined data systems and storytelling that is grounded in evidence. When done well, BRSR Core becomes more than a requirement. It becomes a signal of organizational maturity and long-term resilience.

For organizations willing to make that shift, ESG reporting can move from obligation to advantage.

Contact Us – catalyst@bevolve.ai

Related posts